10.10.2025

Megaconstellations are to drive orbiting satellite totals to new highs.

Every year a consultancy publishes a new 10-year forecast of satellite launches, and the estimate grows to previously unbelievable totals.

The latest is Novaspace’s forecast that 43,000 satellites will be built and launched between 2025 and 2034–about three times more than were launched in the last 10 years.

While predicting events 10 years into the future can be a dubious exercise, Novaspace is certainly right: a huge number of satellites will be built and launched into space in the next decade.

Novaspace anticipates $665 billion in market value will be generated from launch and manufacturing of those 43,000 satellites, it said in a report released on Oct. 7.

The causes of this rocketing total are the usual suspects: lower launch costs, smaller and more capable satellites, and geopolitical rivalry between the U.S. and China.

Low-Earth-orbit megaconstellations encompass all three of those driving forces.

Consider SpaceX’s Starlink: it is launched via the partially reusable Falcon 9 launch vehicle, individual satellites are increasingly capable and small, and the military derivative of the system, Starshield, is intended to help counter China.

China, of course, is not sitting idle. Novaspace judges the country has two credible government-backed megaconstellations: Qianfan and Guowang.

Including SpaceX’s commercial Starlink constellation and Amazon’s Project Kuiper, 66% of satellites to be launched will be part of a megaconstellation, Novaspace says.

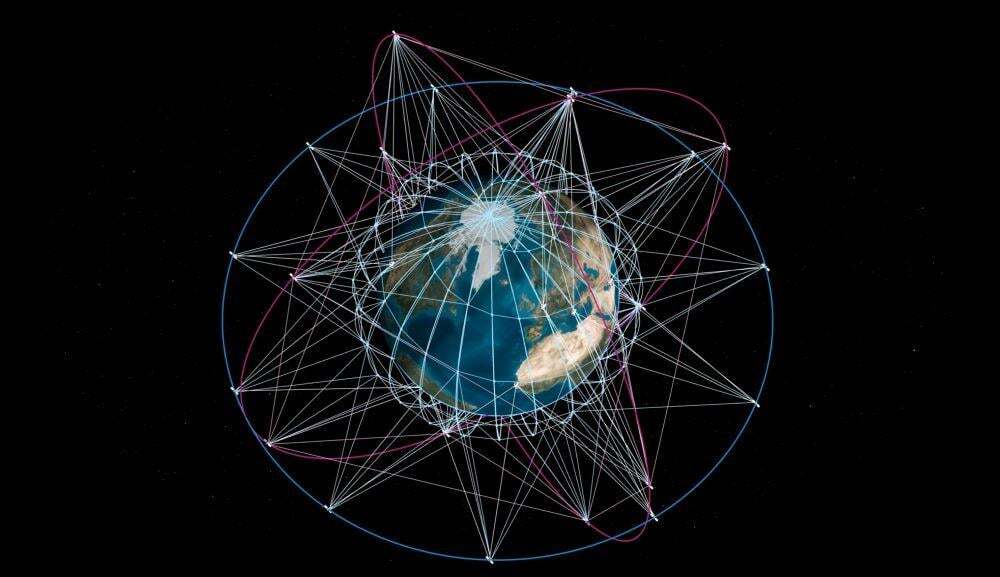

“We’re seeing a rapid expansion in satellite activity and a shift in how space is used,” says Gabriel Deville, manager at Novaspace. “Satellites are no longer just custom-built assets. They’re evolving into interconnected nodes within decentralized networks. This marks a new chapter in orbital complexity and global connectivity.”

Downstream satellite services, such as SpaceX Starlink and Amazon Projects’ broadband internet services, are expected to generate enormous revenue. In 2023 alone, satellite communications, navigation and Earth observation services were estimated to generate €358 billion ($416 billion) in market value, according to the European Space Agency (ESA).

Yet, counterintuitively, megaconstellation satellites are only going to account for 11% of market value for the sector, Novaspace says.

“In contrast, 3,400 satellites weighing more than 500 kg [1,102.3 lb.], operated by 170 satellite operators, will make up 8% of satellites but 72% of value,” the consultancy says.

“Defense is once again confirmed as the main satellite market driver due to increased defense budgets in a deteriorating security environment,” Novaspace says. “While defense users will account for only 9% of future satellites, including two megaconstellations, Starshield and Milnet, they will make up 48% of manufacturing and launch value over 2025-2034.”

In other words, expect the satellite manufacturing industry to remain largely as it has been since the early years of the Cold War: a business focused on serving national security.

Quelle: AVIATION WEEK