28.09.2024

The procurement of massive satellites for missile detection is moving forward despite shift to LEO systems

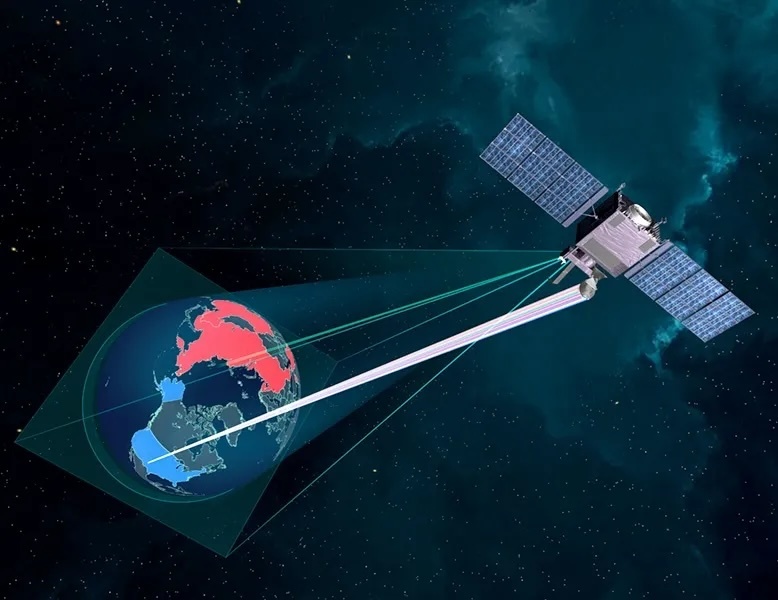

Illustration of a Next-Generation Overhead Persistent Infrared (Next-Gen OPIR) satellite. Credit: Northrop Grumman

WASHINGTON — Amid a growing focus on low Earth orbit satellites, the U.S. Space Force is making strides in a more traditional space-based capability: large missile-warning satellites. The Next-Generation Overhead Persistent Infrared (Next-Gen OPIR) program, with an estimated cost of $14 billion, is among the most expensive satellite procurement efforts in the Space Force today.

These massive satellites play a crucial role in detecting missile launches and providing early warnings of potential threats to U.S. military forces and allied nations. Despite the trend towards smaller, cheaper satellites, the Next-Gen OPIR program underscores the military’s reliance on high-altitude, persistent observation sensors in geostationary and highly elliptical orbits.

Progress amid complexity

Raytheon delivered the first of two infrared payloads for Next-Gen OPIR geosynchronous (GEO) satellites last month, marking a key milestone in the program. Lockheed Martin is building these satellites, with the Space Force now expecting the first GEO satellite to be delivered in late 2025.

Frank Calvelli, the Space Force’s top procurement official, said contractors are meeting milestones and development timelines for Next-Gen OPIR at a faster pace than previous systems like SBIRS (Space-Based Infrared System).

“Current production time has been reduced by 50 percent for Next-Gen OPIR GEO when compared to SBIRS’ initial development,” Calvelli said in a statement to SpaceNews.

The Next-Gen OPIR program, initiated in 2018, includes two GEO and two polar satellites in highly elliptical orbits. Northrop Grumman, leading the polar-orbit satellite program, “has been meeting its planned milestones to date,” according to Calvelli. The first polar satellite, scheduled for launch in 2028, is seen as crucial for monitoring missile threats via Northern Hemisphere routes.

Col. Robert Davis, program executive for space sensing at the Space Systems Command, described the delivery of the first GEO payload as a “key event” in the program. “We’re integrating it right now,” Davis told reporters last week, adding that if tests go well, the Space Force remains on track to potentially launch the first GEO satellite in late 2025.

Meanwhile, the Government Accountability Office has warned of potential technical and schedule risks, citing flight hardware production and integration challenges due to supply chain issues and the complexity of integrating a novel payload.

A layered approach

While advocating for a shift to smaller, cheaper satellites leveraging commercial production lines, Calvelli stressed that some space missions still require “larger, low volume satellite systems.” He emphasized that Next-Gen OPIR “fills a critical need for the missile warning mission and is the last low volume, large sized Space Force OPIR acquisition in the near future.”

In parallel with Next-Gen OPIR, the Pentagon is also investing in LEO and medium Earth orbit (MEO) missile-warning systems as part of a broader strategy to develop a layered missile warning architecture. This multi-orbit strategy aims to counter sophisticated missile threats, including hypersonic glide vehicles and advanced ballistic missiles from adversaries like Russia and China.

“A multilayer architecture is the right thing to do if you look at the resiliency calculations in some of the areas where we’re concerned about,” said Rob Mitrevski, vice president at L3Harris Technologies, a primary contractor for LEO missile-tracking spacecraft the company is producing for a proliferated constellation overseen by the Space Development Agency.

While GEO satellites provide persistent, global coverage, much of the technological innovation in missile detection and tracking is occurring in LEO satellites, Mitrevski said at the recent Air Space & Cyber Conference.

These lower-flying satellites can be deployed in larger numbers, at lower costs, and offer advantages in agility and resilience, he said. LEO sensors can more easily leverage AI for threat identification, he added, allowing for quicker responses to emerging threats such as hypersonic missiles

Jeff Schrader, vice president at Lockheed Martin Space, highlighted the incorporation of “smart sat” technology in LEO missile-tracking satellites that the company is producing for the Space Development Agency.

Smart sats work like an iPhone with third-party applications, he said. “Once it’s flying on orbit, you can actually upload AI and machine learning algorithms,” said Schrader. “We’re developing AI/ML algorithms for Next-Gen OPIR that we could port over to the SDA program to look at and track dim targets.”

Quelle: SN