23.09.2022

When NASA unveiled in 2018 the Commercial Lunar Payload Services (CLPS) program, its effort to fly science and technology demonstration payloads on commercial lunar landers, the phrase agency officials often used to describe it was “shots on goal.” The phrase was meant to describe the agency’s acceptance of risk and expectations of success for the program: just as not every soccer ball or hockey puck makes it into the back of the net, not every CLPS mission was expected to touch down successfully on the lunar surface. The payoff would come in more frequent and less expensive ways of reaching the moon to support science and exploration.

Today, NASA is still waiting for that first shot on goal. The agency has issued task orders for eight missions to five companies: Astrobotic Technology, Draper, Firefly Aerospace, Intuitive Machines and Masten Space Systems. Some of those companies are finally getting close to flying their missions, with launches scheduled for late this year or early next year. Another company, though, has stumbled long before taking its shot on goal.

MASTEN’S STUMBLE

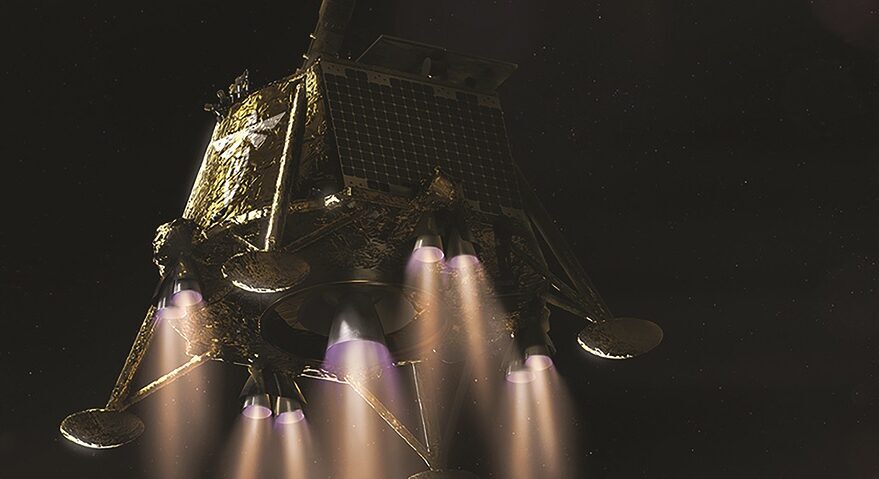

Masten won a CLPS task order in April 2020 for a lander mission to the lunar south polar region. Masten’s XL-1 lander would carry a set of NASA instruments on what the company called Masten Mission One, or MM1.

Masten, a small company based at Mojave Air and Space Port in California, had been best known for developing vertical takeoff and landing rockets, including those that won more than $1 million in 2009 in the Northrop Grumman Lunar Lander Challenge, part of NASA’s Centennial Challenge prize program. The XL-1 lander would be by far the company’s biggest project.

However, the company struggled to develop the lander and delayed its late 2022 launch by a year, citing the effects of the pandemic and supply chain problems. It also failed to raise the money needed to develop the mission, including hiring staff and expanding facilities.

Those problems came to a head July 28, when the company filed for Chapter 11 bankruptcy in federal court in Delaware. The documents Masten filed with the bankruptcy court revealed a company that had bitten off more than it could chew with the CLPS award.

“It was proud of its well-earned gritty, non-corporate reputation in the industry,” Masten’s lawyers said of the company, “but this presented problems when the company needed to scale up rapidly.”

Masten tried to raise $60 million last year, the filings state, but could not find a lead investor. Timing was an issue: by the time Masten went looking for funding, “many investors interested in making substantial investments in space companies had already done so.”

A space company identified in the documents only as Company A approached Masten in March about acquiring it and signed a letter of intent to do so at the end of the month. A month later, though Company A backed out, citing “substantial liabilities recognized to date and additional future projected losses associated with MM1.” Several other potential deals failed to materialize, forcing Masten into Chapter 11 in July.

Masten said at the time of the filing the company planned to use Chapter 11 to reorganize. “Masten intends to use the Chapter 11 process to streamline Masten’s expenses, optimize its operations and conduct sale processes that maximize value for its unsecured creditors,” Sean Bedford, general counsel of Masten, said in a statement.

However, in an Aug. 14 filing, Masten announced it had a “stalking horse” agreement with Astrobotic to sell “substantially all” its assets for $4.2 million, including a $14 million credit on a SpaceX launch contract. Such an agreement guarantees a minimum Masten would get but allows it to seek better offers. Astrobotic declined to comment on the agreement, and the bankruptcy proceedings are set to wrap up in early September.

NASA, which paid Masten $66.1 million of that $81.3 million CLPS award at the time of the Chapter 11 filing, has largely refrained from commenting on the company’s status beyond assuring those with NASA-sponsored payloads on the lander that they will fly, one way or another.

“We’ll find out at the end of their Chapter 11 reorganization if they are ready to fulfill the terms of the task order,” said Joel Kearns, deputy associate administrator for exploration in NASA’s Science Mission Directorate, during a presentation at the annual meeting of the Lunar Exploration Analysis Group (LEAG) Aug. 24 at the Applied Physics Lab in Maryland. “If they’re not, we’ll go manifest those instruments, those investigations, on other delivery opportunities.”

ASTROBOTIC AND INTUITIVE MACHINES PREPARE FOR LAUNCH

Two other companies are preparing to make their first shots on goal. In April, Astrobotic unveiled its Peregrine lander at its Pittsburgh headquarters. The lander was still being assembled — it was missing solar panels, fuel tanks and payloads — but company executives were confident that Peregrine would be ready for launch before the end of the year.

Astrobotic has provided limited updates on the progress of Peregrine since then but is sticking to a launch in the fourth quarter. “We’re continuing integration” of the lander, said Dan Hendrickson, vice president of business development at Astrobotic, at the LEAG meeting.

One complication is that the launch date is not entirely in Astrobotic’s control: the lander is flying on the first launch of United Launch Alliance’s Vulcan Centaur, which has suffered development delays. “We are planning for a mission at the end of this year,” he said but declined to say when the completed lander would need to be delivered to Cape Canaveral to support that, assuming the rocket is ready. “We are actively executing towards that schedule right now.”

Intuitive Machines has also hoped to launch the first of its Nova-C landers, called IM-1, before the end of the year. Problems with a composite propellant tank on the lander, though, delayed work on it.

In an interview in April at the company’s headquarters in Houston, Steve Altemus, president and chief executive of Intuitive Machines, said he was still hoping to launch IM-1 in December but needed to cut 30 days from the schedule to meet that goal. Changes in assembly procedures promised to save 18 days, “so I’ve got to find 12 more days to be able to get off in December.”

Those savings, though, didn’t materialize, and by July the company said it now expected IM-1 to launch in early 2023 on a Falcon 9. The payload space on that lander is sold out with a mix of NASA and commercial payloads, said Trent Martin, vice president of Intuitive Machines, at the LEAG meeting.

For both companies, their landers are just the first of many missions in development. Astrobotic has a second CLPS award for its Griffin lander, a much larger spacecraft that will carry NASA’s Volatiles Investigating Polar Exploration Rover (VIPER) to the south pole of the moon. Intuitive Machines has CLPS orders for two more Nova-C landers, IM-2 and IM-3, and is also starting work on an IM-4 mission.

Their lunar ambitions go beyond landers. Astrobotic has secured NASA funding for CubeRover, a small rover that would fly on a future lander with technology to survive the two-week lunar night. It also won in August a NASA contract to develop solar panels optimized to work at the south pole.

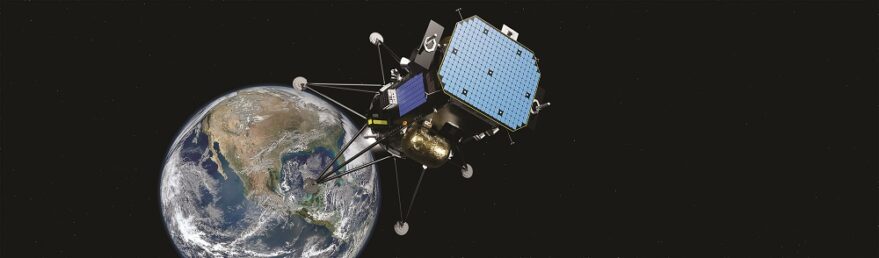

Intuitive Machines is developing a network of satellites around the moon that would relay data from its landers and other missions; those spacecraft will launch as secondary payloads on Nova-C lander missions. “We always assumed we weren’t just building landers,” Martin said. “We’re building landers, providing data back from the moon, and that has expanded into all things cislunar.”

FIREFLY AND DRAPER

Two other companies are in earlier stages of work on their landers. Firefly, best known for its Alpha launch vehicle, won a NASA CLPS award in February 2021 for its Blue Ghost lander, now scheduled to fly to the moon on a Falcon 9 in 2024.

Will Coogan, chief engineer for the lander at Firefly, said at the LEAG meeting that the company has 50 people working full-time on Blue Ghost. That mission passed an integration readiness review in April, confirming the company was ready to move into integration of the lander.

The interconnected nature of the space industry creates for some strange bedfellows. Among the suppliers for Blue Ghost are solar cell manufacturer SolAero and software developer ASI, which are both owned by Rocket Lab, which competes with Firefly in the launch market. Two payloads on the lander are from Honeybee Robotics, which is owned by Blue Origin, another launch company.

“We have four different rocket companies working together to help make this mission possible,” Coogan said. “Sometimes it takes a village. The moon is hard.”

NASA’s latest CLPS award went to Draper, which is providing the SERIES-2 lander for a mission to the lunar farside under a $73 million task order announced July 21. The lander itself is designed by the U.S. subsidiary of Japanese company ispace and will be manufactured by Systima Technologies, while General Atomics Electromagnetic Systems will be responsible for payload integration and testing.

Alan Campbell, program manager for the lander at Draper, said at the LEAG meeting that the lander is quite large. “You can probably fit four or five of us in each of the payload bays,” he said. The lander will ultimately have a payload capacity of 500 kilograms, although it’s unlikely to carry that much on the first mission.

Because the landing site is on the far side of the moon, out of view from the Earth, the mission will bring with it two smallsats from Blue Canyon Technologies that will serve as communications relays. Campbell said Draper has booked a launch but declined to disclose details “until we get a few more things in the paperwork figured out.”

REVISITING SHOTS ON GOAL

All the companies say they know the risks of attempting to land on the moon. The recent track record of such missions globally is mixed: while China has successfully landed three times, India’s first lander and one built by Israel Aerospace Industries for privately funded SpaceIL both crashed while trying to land in 2019.

“I think we know not 100% of these missions are going to succeed. I don’t think any one of us wants to be that does not,” said Firefly’s Coogan. “I would extend that further to say that I do not want one of the first attempts to be one of the ones that fails.”

Astrobotic’s Hendrickson, who has one of those first missions, wants the community to react in much the same way as it did in the commercial cargo program when providers rebounded from launch failures. “We need to steel ourselves and learn from the failures and bounce back,” he said. “We are planning to be more successful than 50/50.”

“It will be a higher risk, and I know NASA understands that,” said Intuitive Machines’ Martin. “It’s the shots-on-goal approach: the more we fly, the better this is going to be, the better the technology is going to get.”

Among those at NASA who promoted the “shots on goal” approach to CLPS is Thomas Zurbuchen, NASA associate administrator for science. “We need to have the patience and make sure that the teams can prove themselves so that if the first one fails, we don’t get scared and walk away,” he said in an Aug. 28 interview.

The program, he argued, has already helped lunar science. “I think from the science community’s perspective, CLPS has been a huge success already since it’s gotten many more people involved.”

That approach, though, has its limits. NASA announced July 18 it was delaying the VIPER launch by a year to do more ground tests of the Griffin lander. That work will add $67.5 million to Astrobotic’s CLPS task order, increasing its value to $320.4 million, far more than other CLPS awards.

Zurbuchen said that decision came from a “risk review” that examined whether the risk of flying VIPER, which costs NASA nearly half a billion dollars, on Griffin was appropriate. “The answer was no, you need to add more testing,” he said. “The delivery model is fine, you just need to add more testing.

He added NASA examined how much it would cost the agency to develop its own lander for VIPER, following a more conventional approach than CLPS. “The answer is a factor of two or three more,” he said.

If CLPS is successful, he sees it expanding beyond delivering science instruments. Such landers could preposition equipment and supplies for Artemis missions, reducing what the crewed landers have to bring with them.

But first, those shots have to find their way into the goal. “There’s a non-zero chance that one or multiple of these missions will not work,” Zurbuchen said, at which point the industry will see how committed NASA is to the CLPS approach. “I sure hope we are.”

Quelle: SN